Welcome to Legal Compliance Tech Sdn. Bhd.

Your partner in legal automation and compliance on AMLA. Our powerful software is designed to take the complexity out of regulatory adherence, ensuring your business operates seamlessly within the confines of the law. With our software, you are now able to automate your legal firm while fully comply with the following AMLA requirements:

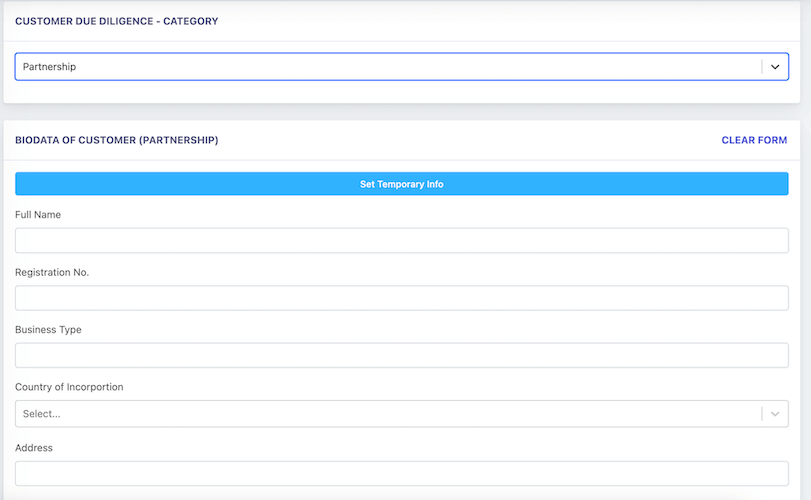

- ❖Customer Due Diligence

- ❖Targeted Financial Sanctions

- ❖Customer Risk Profiling

- ❖Data & Compliance Report (DCR)

- ❖Other AMLA requirements

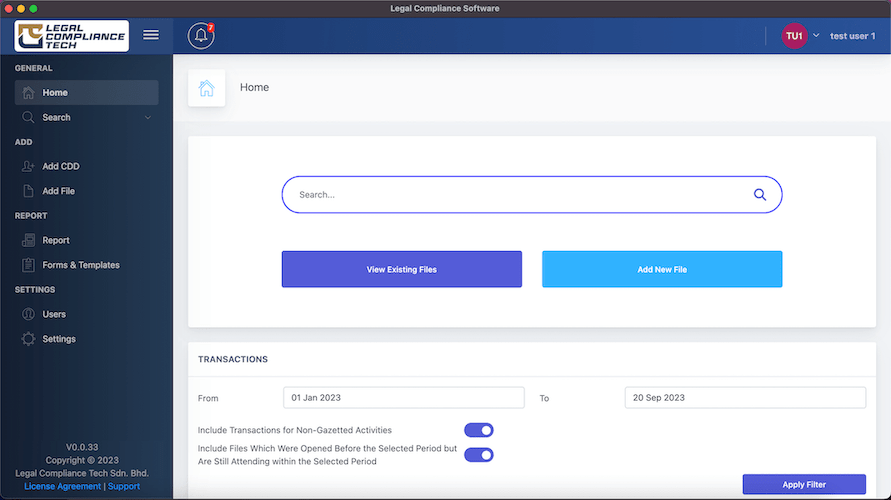

User-Friendly Interface

You do not need to be a tech wizard to use our software. It boasts an intuitive, user-friendly interface that anyone can master quickly. Yet, it also enables you to fully comply with the complex AMLA requirements.

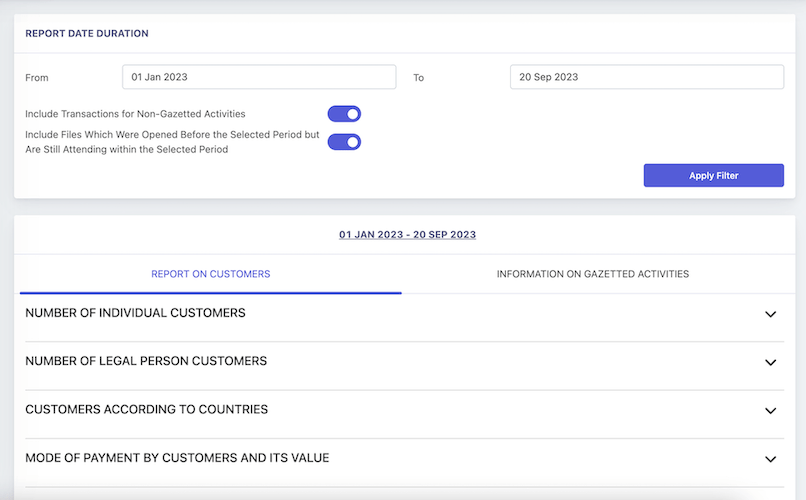

Effortless, Efficient and Comprehensive Report

Say goodbye to the hassle of manually compiling figures for the Data & Compliance Report (DCR). Our software computes the input data and generate detailed reports that document your due diligence efforts in identifying the number of customers, transactions, gazetted activity details and others.

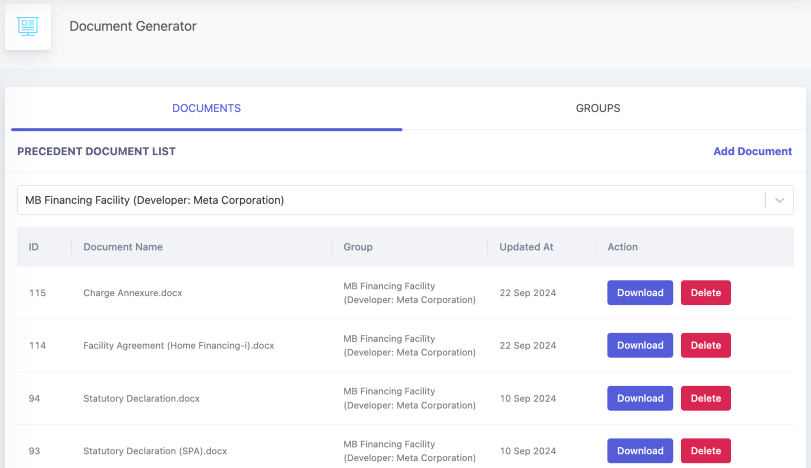

Digitalising Legal Firm with Automation

Our software automation feature will increase the efficiency of your firm while reducing costs and liabilities. With the automation system, you can generate substantial legal documents within "seconds", reduce typographical errors and foster work-life balance for your lawyers and staff.

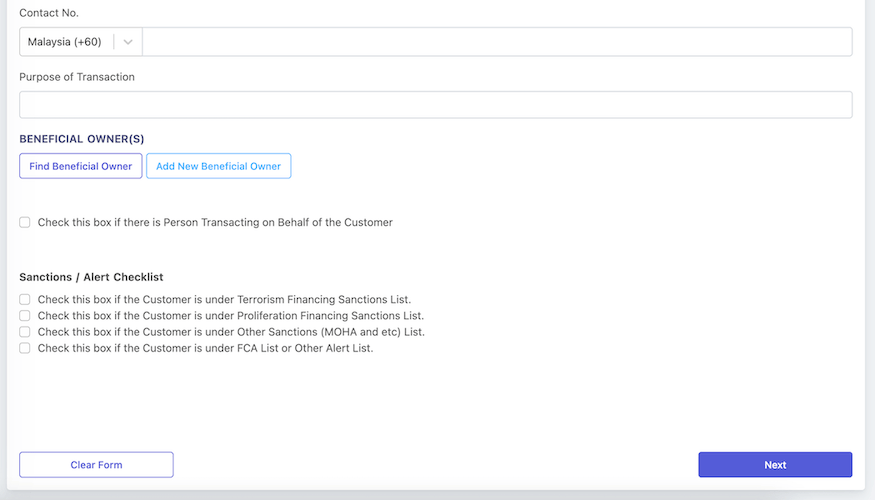

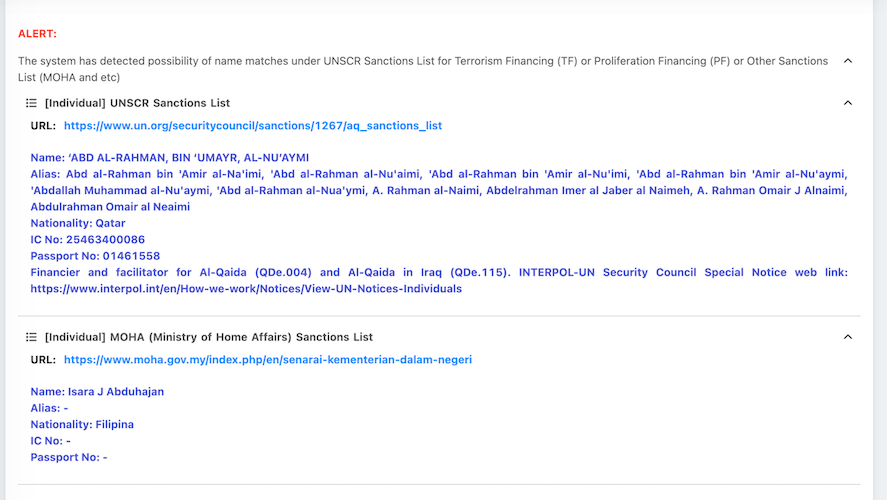

Customer Due Diligence Alert Feature

Minimize legal risks and potential fines by proactively addressing compliance issues.

Our software scans and cross-reference your customer data against global sanctions lists. This ensures that you can identify and act on any clients or entities that are subject to sanctions or restrictions swiftly.

Additional Updates

Yearly Subscription ensures that your software is up-to-date and have the latest sanctions lists loaded into the system.

Support Malaysian I/C Scanner

With additional software and hardware setup on the computer desktop, you can easily extract and autofill the customer data from the Malaysian I/C to the Individual Due Diligence Form.

FAQ

Have a question? Check out our frequently asked questions to find your answer.

Are reporting institutions required to screen every customer against the UNSCR Sanctions Lists and Domestic Sanctions List?

Reporting institutions are required to conduct sanctions screening on existing, potential or new customers against the UNSCR Sanctions Lists and Domestic Sanctions List which state names and particulars of specified or designated individuals or entities as declared by the UNSC or Minister of Home Affairs, as part of the customer due diligence process and on-going due diligence.

For customers which are legal persons, reporting institutions are required to screen the names of the customers such as companies, bodies corporate, foundations, partnerships, or associations and other similar entities, as well as the beneficial owners such as directors and shareholders including nominees, against the sanctions lists.

How often does the UNSCR Sanctions Lists and Domestic Sanctions List get updated?

Reporting institutions are required to keep updated with the UNSCR Sanctions Lists and Domestic Sanctions List, which are updated without any specific intervals.

In the event of a positive name match upon conducting sanctions screening, are reporting institutions required to submit Suspicious Transaction Report (STR) to BNM?

Yes. Submission of STR to BNM is required. The STR should contain information such as details of related transactions or parties.

Is submission of the DCR mandatory?

Yes. Submission of the DCR is compulsory and is an enforceable requirement on all reporting institutions of the specified sectors.

The DCR is issued pursuant to the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act 2001 (AMLA), Financial Services Act 2013, Islamic Financial Services Act 2013 and is a mandatory requirement under paragraph 25.1(a) of the Anti-Money Laundering, Countering Terrorism Financing of Terrorism and Targeted Financial Sanctions for Designated Non-Financial Businesses and Professions (DNFBPs) & Non-Bank Financial Institutions (NBFIs) (AML/CFT and TFS for DNFBPs and NBFIs) [hereinafter referred to as the "Policy Document"].

My firm has ceased operation or ceased to practice. Am I required to submit or declare for DCR?

If your business or company is still legally exist, you need to declare the status of your business or company for DCR.

Only if your firm no longer has any legal existence (i.e. struck off, dissolved or terminated registration of business), then your firm is not required to submit nor declare for DCR.

Does my firm need to submit one DCR for each of my clients?

The DCR is filled and submitted based on your firm's business (as a "reporting institution” under the AMLA) and not your clients'. Each firm who is a reporting institution needs to submit one DCR.

Does my firm need to ensure all my clients who are also reporting institutions to submit DCR?

No. The obligation to ensure that the DCR is submitted is on the reporting institution and its own compliance officer.

If a reporting institution qualifies as small-sized, is the reporting institution exempted from the submission of the DCR?

No, small-sized reporting institutions are still subjected to the DCR submission.

The simplification or exemption are only for selective AML/CFT requirements. This includes simplification on the conduct of employee screening and training and exemption of AML/CFT independent audit functions. Please refer to paragraph 11.1.1 of the Policy Document for more information on the exemptions and simplifications applicable to small-sized reporting institutions.

What are the consequences or penalty for failure to submit the DCR?

Enforcement action can be taken on reporting institutions who fail to submit the DCR within the stipulated timeline.

Could reporting institutions continue business relationship with its customers in the event of failure to obtain the complete Customer Due Diligence (CDD) information?

Reporting institutions must obtain all CDD information (9 data points) as specified in paragraph 14.10.1 of the Policy Document before continuing any business relationship.

In the event of a failure to obtain the complete information, reporting institutions must not continue the business relationship or transaction with the customer and must consider lodging a STR.

However, where reporting institutions form suspicion of money laundering or terrorism financing and reasonably believe that performing CDD may tip-off the customer, the reporting institutions are permitted to proceed to establish business relation or transaction without completing the CDD process, document the basis of not completing the CDD process and immediately lodge a STR.

What are the penalties for non-compliance of AMLA requirements?

Any non-compliance of AMLA requirements by reporting institutions may lead to penalties such as a fine not exceeding RM3 million or imprisonment for a term not exceeding five years or to both.

Why Us?

At Legal Compliance Tech Sdn. Bhd., we are committed to your success. Our team of experts is here to support you every step of the way, from implementation to on-going support. With Legal Compliance Software's advanced features, you can proactively detect high risk customers and sanctions lists matches, helping your business maintain a robust compliance posture and avoid both legal and reputational risks.

* Terms and Conditions apply

Our Awards

Legal Compliance Tech Sdn. Bhd. has been awarded the Malaysia Digital Status by the Malaysian Government, through MDEC.